A payment processor often feels like a simple utility — until it suddenly says “no.” One day, a business opens an account; the next, payouts are held, fees increase, or the application is rejected. Much of this comes down to payment processor business vertical classification, the behind-the-scenes label providers assign to describe what a merchant sells and how risk shows up in transactions.

Vertical classification isn’t just paperwork. It directly influences approvals, pricing, fraud monitoring, chargeback rules, payout timing, and which payment methods a business can offer. For founders and business owners, it’s like choosing the correct line at the airport: pick the wrong one, and every step takes longer.

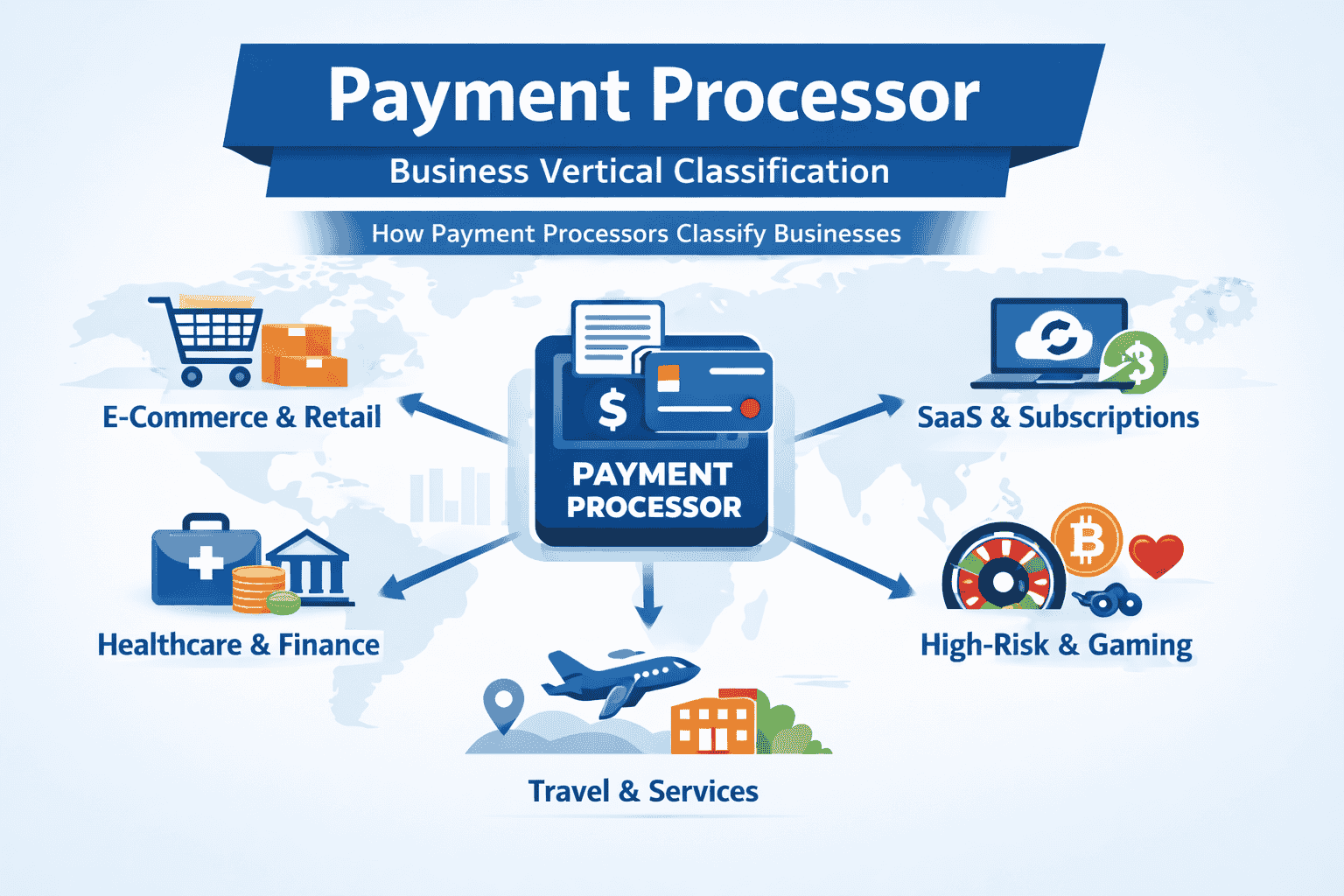

What “business verticals for payment processors” really mean

Payment processor verticals are categories used to group merchants with similar products, rules, and risk patterns. This is part of a broader payment gateway industry classification where providers decide how to underwrite and monitor an account over time.

Two businesses can both “sell online,” but behave nothing alike. A sneaker store ships physical goods with tracking numbers. A subscription app bills monthly with no shipping proof. A travel company may take deposits months before service. Those differences shape disputes, refund rates, and fraud exposure, so processors place them into different payment processing vertical categories.

Vertical classification often blends three layers:

- What is being sold (physical goods, digital goods, services, regulated products).

- How it’s sold (online store payment gateways, in-person POS payment systems for shops, invoices, phone orders).

- How money flows (one-time purchases, subscriptions, deposits, delayed fulfillment, marketplaces).

Many processors also map the business to a Merchant Category Code (MCC), a standard used by card networks and banks. MCC selection can affect card acceptance, interchange, and whether certain card benefits apply. Stripe’s primer on merchant category codes (MCCs) offers a practical look at how MCCs relate to business type.

For a clear example of how gateways think about this labeling, Payfirmly’s breakdown of payment gateway business vertical classification explains how classification ties into approvals, fees, and payout rules.

Common payment processing vertical categories, and what drives the classification

Most merchant services by sector fall into familiar buckets. The names vary, but the decision signals are consistent. Here are the verticals founders run into most often, plus what processors watch inside each.

E-commerce and retail (online and in-person)

This includes payment processors for e-commerce, retail payment processor options, and POS payment systems for shops. Processors typically evaluate shipping timelines, return policies, and product types. Fast fulfillment with tracking tends to look safer than long delivery windows or made-to-order goods.

Retail also splits by channel. An online-only brand needs strong fraud screening and address checks. A brick-and-mortar store leans on card-present data from terminals, which often lowers risk.

SaaS and subscription businesses

SaaS payment processor integration and subscription payment gateways sit in a pattern processors understand well: recurring billing, upgrades, downgrades, and churn. The main red flags are unclear billing descriptors, surprise renewals, and weak cancellation flows. Many disputes in SaaS come from “I forgot I subscribed” complaints, so clear receipts and self-serve cancellations matter.

Healthcare and finance (plus insurance)

Healthcare payment processors may need HIPAA-aligned workflows, patient billing controls, and extra care around data handling. For financial services payment processing, providers pay attention to licensing, refund rules, and whether the business touches sensitive categories like lending, investments, or money movement. Insurance payment verticals can also trigger extra checks due to chargeback risk and regulatory rules.

Search results and provider policies change often here, so founders should confirm compliance requirements directly with the processor before building checkout flows.

High-risk and tightly regulated categories (including gaming, CBD, adult, crypto)

High-risk merchant accounts exist because some sectors have higher dispute rates, legal complexity, or fraud pressure. This group can include payment processors for gaming, CBD payment gateways, adult industry payment processors, and crypto payment vertical classification.

“High-risk” is not a moral label, it’s a risk math label. High refunds, trial offers, unclear marketing claims, and long delivery windows can push a business into this bucket even if the product itself is legal. For context on how providers describe these accounts, Chargebacks911’s overview of high-risk merchant accounts lays out common reasons and what to expect.

Travel and delayed-fulfillment services

Travel industry payment processors and hotel booking payment solutions often face “time gap risk.” The customer pays now, the service happens later, and disputes can rise when plans change. Processors tend to look for clear cancellation terms, strong customer support, and proof of delivery, such as confirmations and check-in records.

What processors use to decide (a quick cheat sheet)

| Signal processors check | Why it matters | Example impact |

| Product type and claims | Risk of disputes and compliance issues | Supplements vs apparel may underwrite differently |

| Fulfillment timing | Disputes rise when delivery is delayed | Pre-orders can trigger reserves |

| Billing model | Recurring billing drives “forgotten charge” disputes | Subscription businesses need clean cancellation |

| Sales channels | Card-present data often reduces fraud | POS may price differently than online |

| Refund and support history | Poor support increases chargebacks | Slow responses can lead to monitoring programs |

| Marketing methods | Aggressive tactics raise dispute risk | Misleading ads can cause account reviews |

In 2026, classification also ties into what payment methods a vertical expects. Industry reporting points to continued growth in digital wallets and account-to-account “pay by bank” options, along with stronger AI-driven fraud checks and new payment patterns driven by automated shopping agents. Trust Payments summarizes several of these shifts in its online payments trends for 2026.

Once your payment infrastructure is mapped, many companies explore AI cloud business management platforms to integrate operations, CRM, and analytics for a more complete backend solution.

How to choose a payment gateway for a vertical (and avoid misclassification)

Founders often ask: best payment processor by industry, or which gateway fits their sector? The better question is whether the business can describe itself in a way that matches how processors classify risk.

A payment processor vertical comparison should focus on fit, not hype. The goal is to get approved, stay approved, and keep chargebacks low.

What to prepare before applying

Accurate business description: Product pages, pricing, and policies should match what the merchant tells underwriting. If a company sells both low-risk and high-risk items, that mix needs to be disclosed.

Clear policies: Refunds, shipping, cancellation, and support contact info should be easy to find. Hidden policies are like tinted windows at night, they make risk teams nervous.

Proof of fulfillment: Tracking, confirmations, service logs, or digital delivery receipts help in disputes. This matters in travel, services, and many high-risk categories.

Billing clarity: Descriptors should match the brand name customers recognize. Confusing descriptors create disputes that look like fraud.

Plan for growth: If a startup expects a jump in volume (influencer launch, seasonal spike, app store feature), it should warn the processor early. Sudden spikes can look like a stolen card burst.

Getting classified correctly without “trying to sound safe”

Some merchants try to soften language and end up misclassified. That can backfire later when monitoring systems detect patterns that don’t fit the stated vertical.

A safer approach is simple:

- Use plain product names and show real inventory or service details.

- Match the website to the legal entity and banking info.

- Be upfront about geographies, currencies, and average ticket size.

- Ask which vertical the processor plans to assign, and why.

If a provider can’t support the needed vertical, it’s better to learn that before migrating checkouts, writing integration code, and training support staff.

Conclusion

Payment processor business vertical classification shapes approvals, pricing, payout timing, and the tools a merchant can use. The right classification comes from alignment: what the business sells, how it fulfills, and how it bills customers. Founders who document their model clearly, keep policies visible, and pick payment solutions for merchants that match their sector end up with fewer surprises and a more stable checkout. The best next step is to confirm the assigned vertical in writing, then build processes that protect risk health as the business grows.

Frequently Asked Questions About Payment Processor Business Vertical Classification

What does “business vertical classification” mean for payment processing?

Payment processor business vertical classification is how a processor (or its underwriting team) labels what a business sells and how it operates. This classification usually maps to an industry type and a risk tier, based on factors like:

- Products or services offered

- Sales channels (online, in-person, phone)

- Refund patterns and dispute history

- Delivery or fulfillment timing

Classification isn’t just for reporting. It can influence whether a business is approved, what rules must be followed, and how accounts are monitored. Two companies with similar websites may land in different payment processing vertical categories depending on billing models or fulfillment methods.

If you’re unsure how your business is classified, request your processor’s assigned vertical and any risk notes tied to it.

Why does vertical classification affect approval, rates, and reserves?

Processors use vertical classification to estimate chargeback and fraud risk. Higher-risk categories often face stricter rules because losses can directly impact the processor. Classification can affect:

- Pricing: higher discount rates or additional fees for riskier categories

- Reserves: holding back funds to cover potential disputes

- Rolling payouts: slower access to funds

- Processing limits: caps on transaction size, daily volume, or monthly volume

- Extra requirements: stronger refund policies, proof of delivery, or clearer billing descriptors

Even clean businesses may face stricter terms if their category historically shows higher disputes. Maintaining clear records, low chargebacks, and proof of fulfillment can sometimes help negotiate better terms over time.

How do processors decide which vertical my business falls into?

Processors evaluate your application and verify details independently. Common inputs include:

- What you sell: physical goods, digital products, services, or regulated items

- When customers receive value: immediate delivery versus delayed fulfillment

- Billing method: one-time purchase, subscription, or installment

- Sales channel: card-present, card-not-present, or marketplace

- History signals: prior chargebacks, refunds, and processing history

If your business has multiple revenue streams, the processor may classify based on the primary revenue driver or the riskiest part of your model.

What happens if my business is classified incorrectly?

Incorrect classification can create significant problems:

- Sudden funding delays

- Added reserves or payout holds

- Reduced transaction limits

- Account closure in extreme cases

It can also cause compliance issues. Certain categories require disclosures, age gates, or marketing restrictions. Being misclassified may expose your business to unnecessary scrutiny or regulatory risk. If you notice discrepancies, request a review and provide a clear summary of:

- Products or services offered

- Fulfillment timing and proof (tracking, logs, records)

- Refund and cancellation policies

- Billing descriptors matching customer expectations

Can I change my vertical classification, and what should I provide?

Yes, businesses can request updates if their model changes or if they believe they were misclassified. Helpful items to provide include:

- A plain-English description of what you sell and who buys

- Fulfillment details and proof (tracking numbers, logs, appointment confirmations)

- Refund, cancellation, and dispute policies

- Recent processing statements and chargeback data

- Any licenses or approvals required for regulated categories

Ensure information is consistent across your website, invoices, and customer communications. Mixed messages are a common reason classifications remain strict or get reassigned incorrectly.